How to Create a Brand Positioning Map That Defines Your Market Edge

Most brands use positioning maps to find where they fit in the market. The smartest brands use them to identify what they can own.

When PUMA partnered with Red Bull Racing and Porsche Design, the marketing strategy wasn’t about finding an empty space on a competitive grid. It was about claiming an intersection – motorsport culture × performance innovation × premium lifestyle – that no other athletic brand could replicate. That positioning became intellectual property. It unlocked partnerships, premium pricing, and a brand ecosystem that competing brands still can’t copy.

Here’s what separates strategic brand positioning maps from generic competitive analysis: the best positioning maps don’t just show you where you stand. They reveal what unique territory you can defensibly own – territory that becomes your IP, your competitive moat, your brand promise to the marketplace.

This guide will show you how to create a brand positioning map that doesn’t just plot competitors – it reveals your unique IP territory, uncovers positioning gaps that become competitive advantages, and gives you the strategic clarity to build IP-led marketing ecosystems that scale.

What is a Brand Positioning Map?

A brand positioning map is a visual tool that plots your brand against competing brands across two key attributes, helping you identify where you stand in the market and where opportunities exist to differentiate. It’s an effective tool for marketers, typically structured as a two-axis grid where brands are positioned based on how they perform or are perceived across specific dimensions – price versus quality, traditional versus innovative, mass market versus niche.

But here’s where most brands get it wrong: they treat positioning maps as static snapshots of competitive landscape. They plot dots, find an empty quadrant, and claim that space without asking the critical question: Can we actually own this territory?

The brands that win – Disney, PUMA, Red Bull, Apple – use positioning maps differently. They use them to visualize their IP opportunities. The map shows them not just where competitors cluster, but what unique territory they can claim through proprietary frameworks, methodologies, experiences, or perspectives that competing brands can’t easily replicate.

While positioning maps and perceptual maps are often used interchangeably, there’s a distinction worth noting. A perceptual map typically reflects consumer preferences based on extensive research – how customers actually perceive brands. A positioning map can be more strategic, showing where you intend to position based on your capabilities and IP. The best approach combines both: understand current perception through focus groups and market research, then chart where you want to move based on what you can defensibly own.

At unmtchd., product positioning maps are the first step in codifying brand IP. They reveal what makes a brand unmatched – and what strategic territory can be structured into scalable frameworks, partnerships, and ecosystems.

Why Brand Positioning Maps Matter (And Why Most Brands Get Them Wrong)

Here’s the uncomfortable truth: most marketers use positioning maps to discover empty quadrants, then try to shoehorn their brand’s offering into that space. This approach leads to reactive positioning, not strategic differentiation. It’s why so many brands sound the same, look the same, and compete purely on price or features.

The brands that build lasting value – the ones that scale to nine figures and beyond – don’t chase gaps. They identify territory they can own through intellectual property that competing brands can’t replicate.

Brand positioning maps should provide valuable insights into three things:

Where competitors cluster (so you can avoid commodity positioning where everyone makes the same claims and differentiation becomes impossible)

What attributes actually matter to your audience (not just industry standards or what competitors are measuring, but what your specific target market and potential customers value based on consumer preferences)

What unique territory you can own (based on your brand’s IP – methodologies you’ve developed, perspectives you have from unique experience, or cultural connections others can’t access)

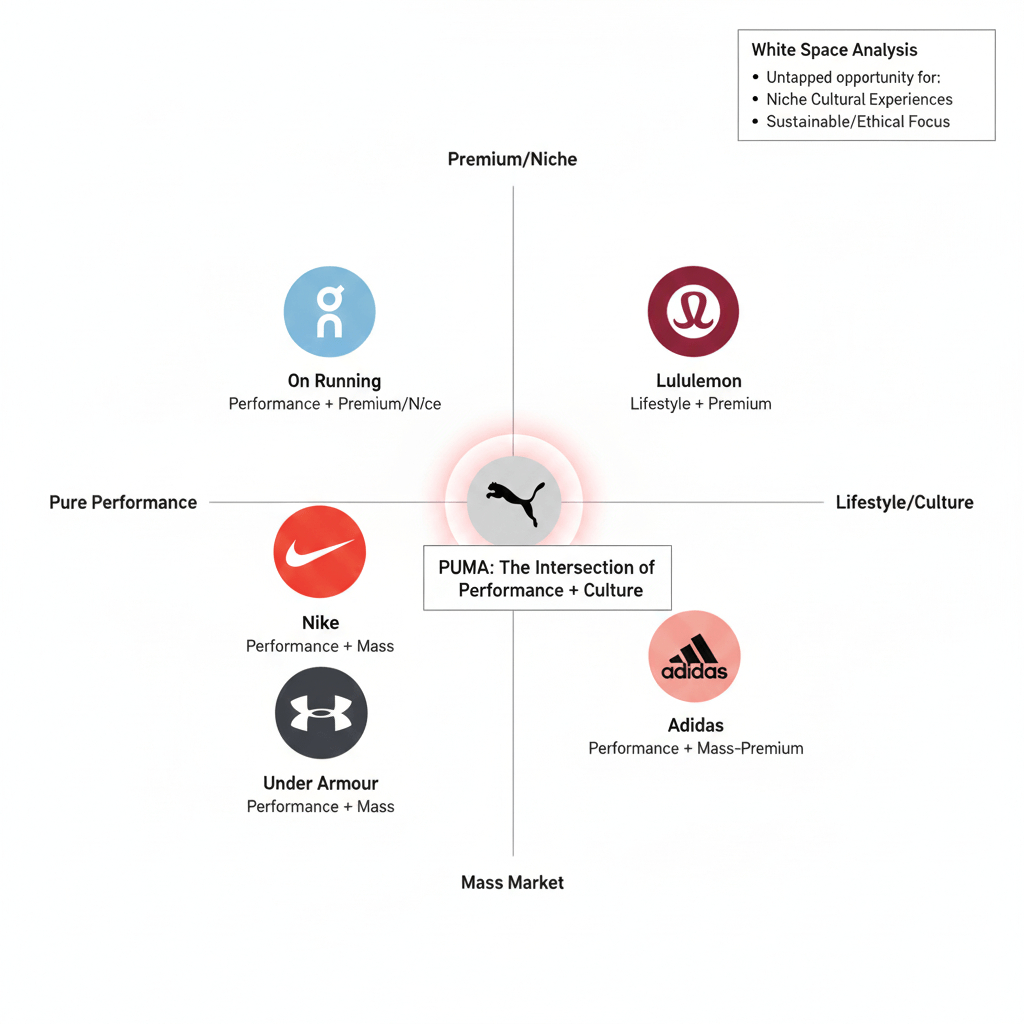

Consider PUMA’s marketing strategy and positioning. When most athletic brands were clustering around “performance innovation” and “technical superiority,” PUMA identified an intersection no one else owned: performance meets street culture.

This wasn’t an empty quadrant they stumbled into. It was strategic territory they could claim through extensive research and partnerships with Red Bull Racing, Porsche Design, and BMW Motorsport – relationships rooted in decades of brand-building at the intersection of sports and lifestyle.

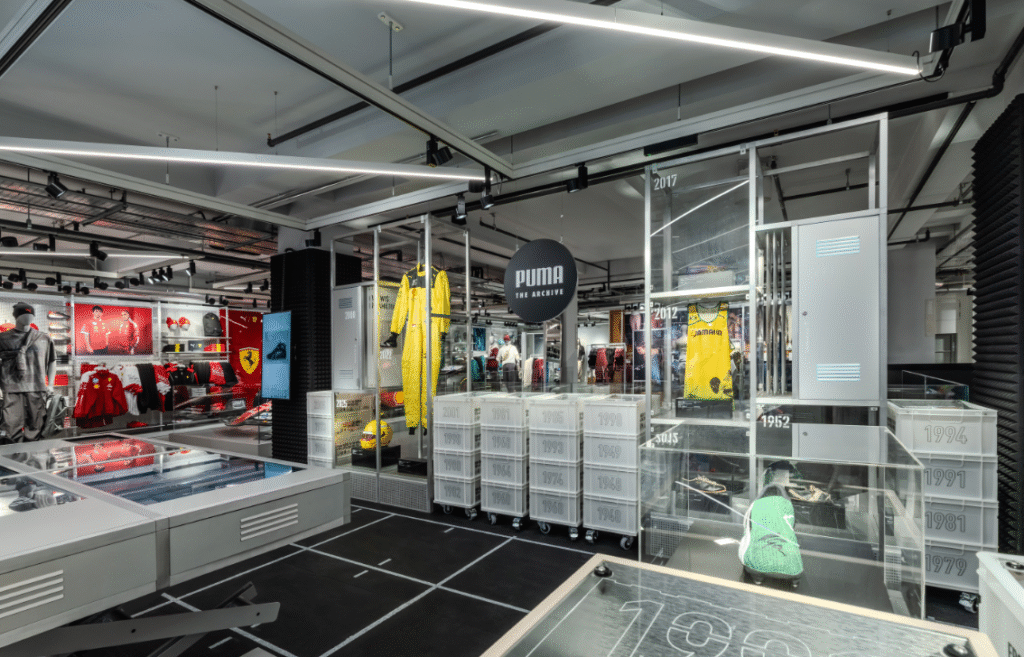

That positioning became IP. It informed product development (motorsport-inspired collections), partnership strategy (Red Bull, Porsche, not just any brand), retail experience (PUMA stores that feel like cultural destinations, not just athletic retailers), and content strategy (stories about culture-makers, not just athletes). Competing brands couldn’t simply copy the position because PUMA owned the ecosystem that made it credible.

Or look at Disney’s positioning approach. Disney never positioned against Universal or Paramount on traditional axes like “family entertainment budget” versus “premium pricing.” Instead, they created entirely new territory: immersive storytelling universes. That positioning – a strategic choice backed by their ability to create interconnected IP across films, parks, merchandise, and experiences – unlocked what became a $200 billion brand ecosystem. The positioning map didn’t show them a gap to fill. It revealed territory they could own that would enable universe-building at scale.

Red Bull offers another instance of positioning-as-IP-strategy. They didn’t use a positioning map to compete in the beverage marketplace against Coca-Cola or Pepsi. They used strategic positioning to create a new category entirely: energy lifestyle brand. The map might have shown them competing with soft drinks. Instead, they owned extreme sports, content creation, and cultural experiences. That position – backed by proprietary events (Red Bull Air Race, Stratos, Rampage) and media (Red Bull Media House) – became impossible to replicate.

The pattern is clear: positioning maps are only as valuable as the strategy behind them. Used well, they reveal your brand’s unique IP territory – what you can own that competitors can’t touch. Used poorly, they trap you in commodity thinking where you’re constantly reacting to what others are doing rather than claiming your own ground.

According to research from the Harvard Business Review, brands that establish clear, defensible positioning based on unique capabilities achieve 3-4x higher customer lifetime value than those competing on generic attributes. The difference isn’t just marketing – it’s strategic clarity about what you own.

How to Create a Brand Positioning Map in 7 Steps

Creating a brand positioning map isn’t just about plotting dots on a chart. It’s a strategic exercise in identifying what makes your brand unmatched – and what territory you can defensibly own. Here’s how to do it right.

Step 1: Define Your Strategic Intent Before Drawing Anything

Most guides tell you to “draw a positioning map” first. Start with strategy instead.

Before you plot a single competitor or choose any attributes, answer these questions:

What market are you actually competing in? Not your industry – your market mindset. PUMA doesn’t compete in “athletic footwear.” They compete in “performance culture.” That distinction changes everything about how you position.

Who are you building for? A specific segment with specific needs, not “everyone who wants quality products.” unmtchd. doesn’t serve “all founders.” It serves founders and brand leaders at the intersection of fashion, sports, and culture who want to build IP-led ecosystems. That specificity determines what attributes matter.

What can you offer that competing brands can’t replicate? This is your IP filter. What perspective, methodology, or framework is uniquely yours based on your experience, capabilities, or connections?

Before mapping, audit your existing IP. At unmtchd., this follows the IP Stack methodology:

Brand IP: What perspective, methodology, or framework is uniquely yours? For instance, PUMA’s “performance meets culture” lens was earned through decades of motorsport partnerships.

Experience IP: What have you done – teams you’ve led, companies you’ve built, industries you’ve navigated – that others haven’t?

Cultural IP: What cultural insights or connections do you have that competing brands don’t? For Red Bull, it’s authentic credibility in extreme sports earned through decades of athlete relationships and event creation.

When positioning PUMA’s FUTROGRADE initiative at New York Fashion Week, the strategy didn’t start by mapping athletic brands. It started by identifying ideas about what PUMA could own that Nike and Adidas couldn’t: the intersection of performance innovation and fashion-forward street culture, rooted in partnerships that gave them cultural credibility in motorsport and lifestyle spaces others couldn’t access.

Source: https://about.puma.com/en/newsroom/news/puma-presents-futrograde

Your deliverable from Step 1: Write 3-5 sentences describing your brand’s unique territory before you start mapping. This becomes your north star for every decision that follows.

Step 2: Select Positioning Attributes That Actually Matter

The most common mistake in creating positioning maps: choosing generic attributes like “price” and “quality.” These create commodity maps where everyone clusters in the same quadrant claiming “high quality at a fair price.” There’s no strategic value in plotting what everyone else is plotting.

Better attribute selection requires a framework that reflects actual consumer preferences:

Attribute Type 1: Category Conventions

What do all competing brands in your space claim? This shows you what NOT to compete on. In athletic wear, everyone claims “performance” and “innovation.” In consulting, everyone claims “strategic” and “results-driven.” These are table stakes, not differentiators. Map them to see the cluster, then choose your second axis strategically.

Attribute Type 2: Audience Values

What does your specific audience actually care about based on extensive research and consumer preferences? Not what industry benchmarks say matters – what your target segment values. For instance, in Gen Alpha brands, research from unmtchd.’s Generation Alpha Trend Report shows they value “authentic” versus “manufactured” and “digital-first” versus “traditional” far more than conventional price or feature attributes.

Attribute Type 3: IP Dimensions

What unique capabilities or perspectives can you actually defend? This is where strategic positioning becomes intellectual property. For consultancies, it might be “method-driven” versus “intuition-based.” For brands, it could be “ecosystem play” versus “product focus.” For creators, “content volume” versus “IP depth.”

The unmtchd. approach for marketers: Choose one attribute that reflects industry standards (so you can show where competing brands cluster and why that’s a problem) and one attribute that reflects YOUR unique lens on the marketplace (this reveals white space only you can fill based on your IP).

What are key dimensions for brand positioning map?

The right dimensions depend on your industry, audience values, and strategic goals. Ultimately, effective attributes reveal competitive dynamics and strategic opportunities. Here are frameworks for choosing dimensions that provide valuable insights:

For Product Brands:

- Price (Affordable ↔ Premium)

- Innovation (Traditional ↔ Cutting-Edge)

- Distribution (Mass Market ↔ Exclusive)

- Experience (Functional ↔ Emotional)

- Focus (Product ↔ Ecosystem)

For Service Brands:

- Delivery (DIY/Self-Service ↔ Done-For-You)

- Expertise (Generalist ↔ Specialist)

- Scale (Boutique ↔ Enterprise)

- Approach (Framework-Driven ↔ Custom)

- Pricing Model (Project-Based ↔ Retainer/Membership)

For Creator/Founder Brands:

- Content (Volume/Reach ↔ Depth/IP)

- Monetization (Sponsorships ↔ Products/Ecosystems)

- Community (Audience Size ↔ Community Value)

- Focus (Teaching/Content ↔ Building/Systems)

- Platform (Multi-Platform ↔ Owned Platform)

Example from the athletic wear marketplace:

Traditional axes everyone uses: Price (Low/High) × Performance (Basic/Advanced). Result: Everyone clusters in “High Performance, Premium Price.” No differentiation.

Strategic axes that reveal IP territory: “Product Focus” × “Cultural Currency.” Result: Reveals PUMA’s unique position at “Cultural Currency + Performance Innovation” through partnerships no competitor can replicate (Red Bull Racing, Porsche Design, BMW Motorsport). This position becomes defensible IP, not just marketing spin.

Step 3: Plot Your Current Position (Not Where You Wish You Were)

Be brutally honest about where your brand’s offering actually sits in the minds of potential customers today, not where your brand guidelines say you should be. The gap between perception and intention is your strategic challenge – and your opportunity.

The process:

Plot yourself first based on customer feedback, reviews, social listening, and actual buying behavior – not brand documents. Where do customers place you when they describe your brand to others?

Add competing brands who customers actually compare you to in purchase decisions. Not who you think you compete with, but who shows up in customer consideration sets based on market research.

Add aspirational competitors representing where you want to move. These are brands in adjacent categories or premium positions that set the standard you’re working toward.

Size the circles to reflect market share or mindshare in the marketplace. Bigger circles = larger presence in customer consideration. This shows you the competitive reality, not just who’s talking loudest.

The gap between where you think you are and where customers place you IS your brand strategy challenge. Most brands overestimate their positioning on innovation, underestimate their positioning on price, and completely misread their cultural relevance.

When mapping PUMA against Nike and Adidas from a consumer perception standpoint, most internal stakeholders wanted to plot PUMA in the “pure performance innovation” quadrant. But customer research and focus groups showed PUMA actually owned “performance meets street culture” – a position that became the foundation for partnerships with Red Bull, Porsche Design, and BMW Motorsport. Accepting the truth of the current positioning enabled strategic decisions about where to move and what IP to build.

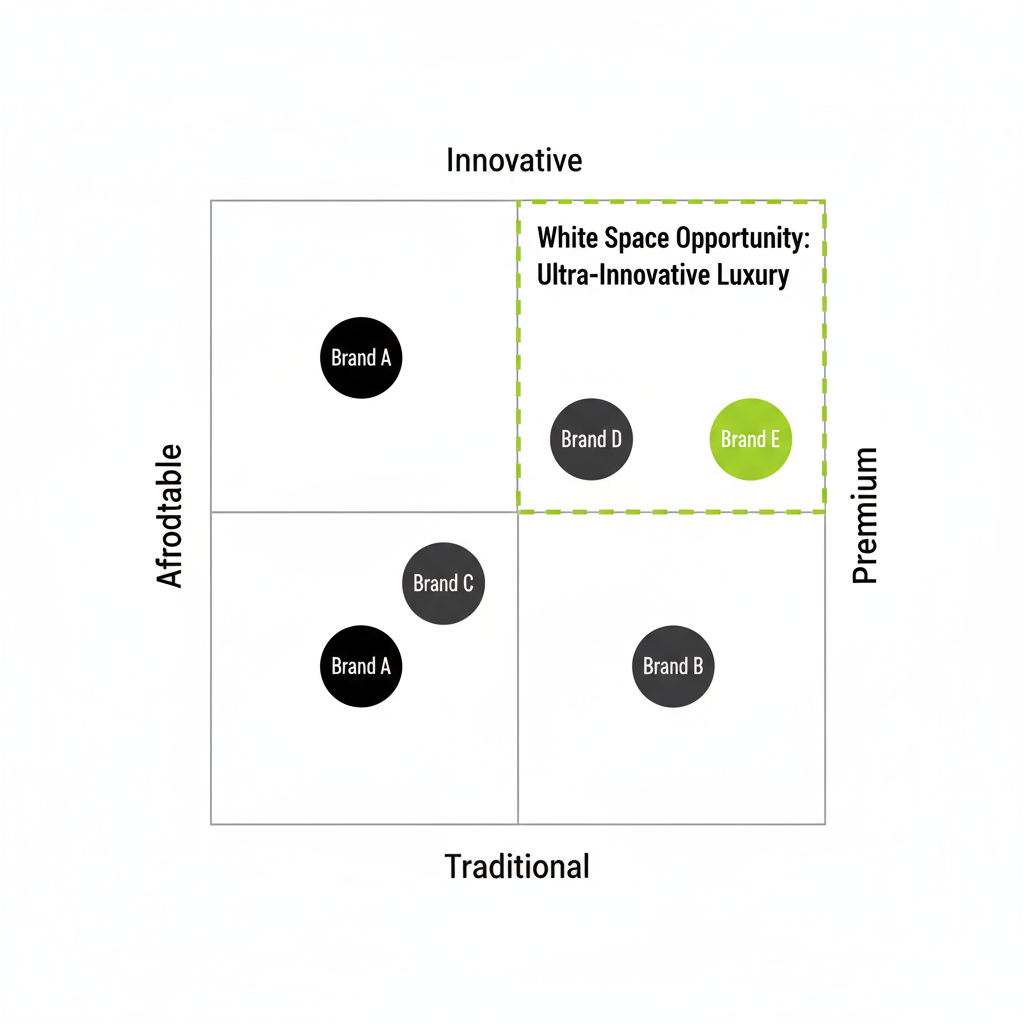

Step 4: Find Positioning Gaps That Reflect Actual Opportunity

An empty quadrant doesn’t automatically mean opportunity. It might mean that position is undesirable to customers, unprofitable to serve, or impossible to defend against competition. White space requires validation through extensive research.

Evaluate positioning gaps through three strategic filters:

Filter 1: Is it desirable?

Would potential customers actually value this position based on their stated preferences and behavior? Use customer research, not internal assumptions. The quadrant “affordable luxury” sounds appealing until you realize customers don’t believe those two attributes can coexist – luxury implies premium pricing, or it’s not really luxury.

Filter 2: Is it defensible?

Can you own this territory through your IP, experience, or capabilities? Or can competing brands easily copy it? “Best customer service” isn’t defensible unless you have proprietary systems, training methodologies, or technology that competitors can’t replicate. “Performance meets culture” is defensible when backed by decades of motorsport partnerships (PUMA) that take years to build and can’t be purchased overnight.

Filter 3: Is it profitable?

Does this position support your business model and growth goals? Some positions attract customers who won’t pay premium prices or require service levels that destroy margins. “Affordable + Premium” might attract customers, but it’s rarely profitable at scale.

The unmtchd. IP Test: Before claiming any positioning territory, ask: “What IP do we have – or can we build – that makes this position ours?” If the answer is “we’ll just market it better,” that’s not a defensible position. That’s advertising spend competing against everyone else’s advertising spend.

Examples of good versus bad white space:

Bad White Space: “Affordable AND Premium” (contradictory attributes customers don’t believe can coexist)

Good White Space: “Premium Performance with Cultural Credibility” (PUMA’s territory through strategic motorsport partnerships that took decades to build)

Bad White Space: “High Quality, Low Price” (unsustainable economics that eventually force you to compromise quality or raise prices, destroying your positioning)

Good White Space: “IP-Led Brand Ecosystems for Fashion/Sports/Culture Brands” (unmtchd.’s territory, defensible through 20 years of experience building systems at Disney, PUMA, Warner Bros – experience competing brands can’t acquire)

Want to identify your brand’s defensible positioning territory? Contact us to map your brand IP and uncover strategic positioning opportunities that competitors can’t replicate.

Step 5: Create Multiple Maps with Different Attribute Pairs

Don’t stop at one map. Create 3-5 maps using different attribute combinations to reveal different strategic truths and visualize various marketplace dynamics. One map shows you one perspective. Multiple maps show you the full picture of your competitive landscape and IP opportunities.

Map combination strategy to fine-tune your positioning:

Map 1: Industry Standards

Plot what competing brands are claiming (shows where NOT to play because everyone’s crowded in the same quadrant making the same promises)

Map 2: Customer Values

Plot what your audience actually cares about based on consumer preferences from focus groups and research (shows differentiation opportunities based on real customer priorities, not industry assumptions)

Map 3: IP Dimensions

Plot what you can uniquely own (shows defensible territory based on your experience, methodologies, or capabilities competing brands can’t replicate)

Example for a brand strategy consultancy:

Map 1: “Hands-On” vs. “Done-For-You” × “Generalist” vs. “Specialist” – Shows most consultancies clustering in “Done-For-You Generalist” (commodity positioning)

Map 2: “Teaching” vs. “Building” × “Community” vs. “1:1” – Reveals customers actually value “Building + Community,” which most consultancies don’t offer

Map 3: “Framework-Driven” vs. “Custom” × “Content Focus” vs. “IP Focus” – Shows unique territory at “Framework-Driven + IP Focus” that becomes defensible intellectual property

Why this matters: Different maps reveal different strategic opportunities. One map might show you’re in a crowded space. Another might reveal you have a clear lane no one else occupies. The third might show you what IP you need to develop to make your position defensible.

Step 6: Turn Map Insights into Your Positioning Statement

The map is a diagnostic tool that provides valuable insights. Now translate it into your marketing strategy and brand promise.

Your positioning statement should articulate who you serve, what unique value you provide, and why they should believe you – all based on the insights from your positioning maps. This isn’t creative copywriting. It’s strategic clarity about your market position and defensible IP.

The unmtchd. positioning statement template:

“For [target audience], [Brand Name] is the [positioning category] that [unique value proposition] because [IP/credibility proof].”

Each element serves a purpose:

Target audience: Who you identified through your mapping as the segment that values your unique position

Positioning category: The territory you’re claiming in the marketplace (not a generic industry label, but your specific space)

Unique value proposition: What you offer that competing brands in your map cluster don’t or can’t

IP/credibility proof: The defensible reason your position is yours – experience, methodology, partnerships, capabilities

Example – unmtchd.’s positioning:

“For founders and brand leaders building at the intersection of fashion, sports, and culture, unmtchd. is the strategic partner that turns expertise into IP-led ecosystems because we’ve spent 20 years building billion-dollar brand systems at Disney, Warner Bros, Paramount, and PUMA.”

This positioning emerged directly from mapping the brand strategy market: most consultancies cluster in “tactical execution” or “generalist strategy.” unmtchd. owns “IP-led frameworks for fashion/sports/culture brands” – a position defensible through specific industry experience competing brands don’t have.

Example – PUMA’s positioning (simplified):

“For athletes and culture-creators who live at the intersection of performance and lifestyle, PUMA is the only global sports brand that delivers both technical innovation and cultural credibility through partnerships with the world’s most exciting brands in motorsport, fashion, and music.”

This position – revealed through competitive mapping that showed Nike and Adidas clustering in “pure performance” – became defensible through partnerships (Red Bull, Porsche, BMW) that took decades to build and couldn’t be replicated overnight.

For more detailed guidance on translating positioning into actionable brand strategy, explore how to develop positioning strategies rooted in intellectual property.

Common mistakes to avoid:

Too broad: “We’re for everyone who wants quality” (no positioning, no strategy, just vague promises)

No differentiation: “We provide innovative solutions” (what every competitor claims, means nothing)

No proof: Claims without credible IP backing (why should anyone believe you can deliver what you’re promising?)

Step 7: Create an External Expression of Your Positioning

Your positioning statement is internal – it guides strategy, product development, partnerships, and your marketing strategy. Your tagline or slogan is external – the consumer-facing expression of your strategic position and brand promise that makes your brand memorable to potential customers.

Tagline principles:

Short – 2-7 words is ideal. Longer taglines don’t stick in memory.

Memorable – Easy to recall and repeat. If customers can’t remember it, it doesn’t work.

Ownable – Reflects your unique territory, not generic claims anyone could make.

Emotionally resonant – Connects to deeper values beyond functional benefits.

Examples of positioning translated to taglines:

| Brand | Strategic Positioning | External Tagline |

| Nike | Performance + Inspiration for all athletes | “Just Do It” |

| Avis | Challenger brand + Superior service | “We Try Harder” |

| PUMA | Performance + Culture | “Forever Faster” |

| Apple | Innovative technology + Creative empowerment | “Think Different” |

| unmtchd. | IP-led brand building for fashion/sports/culture | “IP Ownership Is the New Influence” |

Notice that great taglines reflect positioning without being literal translations. They capture the feeling of your position, not the mechanics. “We Try Harder” embodies Avis’s challenger position without saying “we’re number two.” “Just Do It” embodies Nike’s performance + inspiration positioning without mentioning shoes.

Your tagline becomes the shorthand for everything your brand represents – the compressed version of your positioning that customers remember long after they’ve forgotten the details.

How to Turn Your Brand Positioning Map into Action

Creating the map is step one. Marketing strategy happens when you translate insights into decisions about products, partnerships, and growth. Here’s how to activate your positioning.

Build Marketing That Reinforces Your Position

Every marketing decision should reinforce your chosen position. Your positioning map shows you what to emphasize, what to de-emphasize, and what to ignore entirely in the marketplace.

Strategic questions to answer:

Content: What topics reinforce your unique position? For instance, if you own “IP-led brand building,” create content about frameworks, ownership, and ecosystems – not generic “5 marketing tips” listicles that any brand could publish. Your content should make your positioning tangible.

Channels: Where does your target audience expect brands in your position to show up? Premium brands need premium channels. Cultural brands need cultural platforms. B2B brands need different touchpoints than DTC brands. Your positioning determines where you belong in the marketplace.

Partnerships: What collaborations reinforce your positioning? PUMA × Red Bull Racing reinforced “performance + culture.” Disney × Star Wars reinforced “immersive story universes.” Random partnerships that don’t align with your position dilute your brand.

Tone: Does your positioning require authoritative expertise? Cultural edge? Accessible warmth? Your tone must match your position. A challenger brand sounds different from a market leader. A premium brand sounds different from a value brand.

unmtchd. example:

Positioning at “IP ownership for fashion/sports/culture brands” means content focuses on frameworks, methodology, and strategic brand building – not growth hacks or viral tactics. Partnerships target brands and institutions at the intersection of fashion, sports, and culture (PUMA, not random SaaS companies). Tone is editorial-strategic (Business of Fashion meets Fast Company), not motivational-casual. Every decision reinforces the same strategic position.

According to research from Nielsen, consistent brand positioning across all touchpoints increases purchase intent by 23% and brand loyalty by 33%. Consistency turns positioning into equity.

Refine Your Audience Based on Positioning Insights

Your positioning map should clarify who you’re NOT targeting as much as who you are. Every brand that tries to be everything to everyone ends up being nothing to no one. Ultimately, clear positioning means choosing your audience deliberately.

Audience clarity framework:

Primary Audience: Who sits in your positioning quadrant and values what you uniquely offer? These are potential customers who will pay premium prices, stay loyal, and refer others because your position solves their specific need better than alternatives.

Secondary Audience: Who might value your position but isn’t the core focus? These customers get secondary marketing attention and may become primary over time, but they’re not your strategic priority today.

Non-Audience: Who will never value your positioning, no matter how good your marketing? Stop trying to convert them. They want something you don’t offer, and that’s fine. Clear positioning means choosing what you’re not.

Example – unmtchd.’s audience clarity:

Primary: Founders and brand leaders in fashion, sports, culture industries building IP-led businesses (they value strategic frameworks over tactical execution)

Secondary: Marketing directors at mid-market brands looking for strategic depth beyond agency execution (they understand IP but may need education on application)

Non-Audience: Startups looking for growth hacks, agencies seeking tactical templates, brands wanting quick wins over long-term equity building (they want things unmtchd. doesn’t offer, by design)

Positioning means choosing. The clearer you are about who you don’t serve, the stronger your position becomes with who you do serve.

Ensure Visual and Verbal Identity Reflect Your Positioning

Your brand identity – visual, verbal, experiential – must match your strategic positioning and brand promise. Misalignment creates confusion and erodes trust. When what you say doesn’t match what you look like or sound like, potential customers don’t believe you.

Identity alignment checklist:

Visual: Does your design aesthetic reflect your position? Premium requires premium design. Innovative requires modern aesthetics. Traditional requires classic execution. Cultural requires edge. If you position as “cutting-edge innovation” but your website looks like 2010, there’s a disconnect.

Verbal: Does your tone match your position? Experts sound authoritative. Peers sound conversational. Challengers sound provocative. Leaders sound confident. If you position as “challenger brand disrupting the industry” but your copy sounds corporate and safe, customers won’t believe your positioning.

Experiential: Do customer touchpoints deliver on your positioning promise? For instance, if you position as “premium experience” but your checkout process is clunky, your packaging is cheap, and your customer service is automated, the experience contradicts the positioning.

Example of positioning-identity alignment:

PUMA positions at “performance meets culture.” Their product design reflects this (motorsport-inspired collections with fashion-forward aesthetics). Their retail environments feel like cultural destinations, not just athletic stores. Their partnerships (Red Bull, Porsche, BMW) reinforce cultural credibility. Their sponsored athletes are culture-makers, not just performers. Everything aligns with the strategic position.

Use Positioning to Build Long-Term Brand Equity

Consistency is how positioning becomes brand equity. Every interaction should reinforce your unique position. Over time, consistency creates mental availability – when customers think of your category, they think of your brand first because your position is clear and memorable in the marketplace.

Brand equity drivers through positioning:

Consistency: Does every touchpoint deliver on your positioning promise? Inconsistency destroys positioning faster than competition. If you position one way in advertising but deliver differently in experience, potential customers lose trust.

Distinctiveness: Is your position memorable and differentiated enough to create preference? Generic positions create generic brands. Distinctive positions create brands customers actively choose and recommend.

Relevance: Does your position solve a real need for your target audience? Differentiation without relevance is just noise. Your unique position must matter to the customers you serve.

Brand equity isn’t built on content volume. It’s built on IP ownership and strategic consistency. Your positioning is your north star – every decision either reinforces it or dilutes it. After 20 years building brand systems at Disney, Warner Bros, and PUMA, the pattern is clear: brands that maintain positioning consistency for 3-5 years build exponentially more value than brands that chase trends or pivot positioning based on quarterly results.

Building a brand that lasts requires more than tactics – it requires strategic clarity rooted in defensible IP. Join The unmtchd. Collective to access positioning frameworks, strategy sessions, and a community of brand builders.

Brand Positioning Map Best Practices (What Actually Works)

Here’s what actually moves the needle for marketers:

Start with Customer Research, Not Assumptions

Your positioning should reflect how customers perceive value, not how you want them to perceive it. Use surveys, interviews, focus groups, social listening, and behavioral data to validate your map before committing resources. The most expensive positioning mistakes come from internal assumptions that don’t match marketplace reality.

Revisit Your Map Every 12-18 Months

Markets shift. Competing brands move. Customer priorities evolve. Your positioning should evolve based on new data and competitive dynamics. Brands that set positioning once and never revisit it get left behind. Schedule annual positioning reviews that include customer research, competitive analysis, and leadership alignment to fine-tune your strategy.

Test Your Positioning with Real Customers

Before committing to a position, validate it with potential customers through focus groups and one-on-one research. Show your positioning statement to target customers. Do they understand it? Do they value what you’re claiming? Can they articulate why you’re different? If real customers can’t explain your positioning back to you, it’s not clear enough.

Connect Positioning to IP Development

The best positioning strategies unlock IP opportunities. Ask: “What frameworks, methodologies, or perspectives can we develop that make this position defensible?” Positioning without IP is just marketing. Positioning with IP becomes long-term competitive advantage.

At unmtchd., every positioning strategy includes IP mapping – identifying what intellectual property needs to be developed to make the position ownable. For consultancies, that might mean creating proprietary frameworks. For product brands, that might mean developing unique methodologies or partnership ecosystems. For creators, that might mean building signature courses or community platforms.

Align Leadership Before Going External

Your positioning strategy is useless if leadership isn’t aligned. Get buy-in across departments – product, marketing, sales, customer success – before communicating externally. Misalignment shows up immediately in customer experience. If marketing says one thing but product delivers another, positioning fails in the marketplace.

The hardest part of repositioning isn’t the map or the strategy document. It’s getting everyone in the organization to believe in the new direction and execute consistently. Ultimately, invest time in internal alignment before external launch.

Brand Positioning Map Examples: What Works (And Why)

Real examples reveal how strategic positioning translates into market success and defensible competitive advantage in the marketplace.

Example 1: Athletic/Sportswear Market

Analysis:

Most brands cluster in “performance + mass market” – Nike, Adidas, Under Armour all compete in the same quadrant with similar claims about technical innovation and athletic performance. This commoditizes the category. Differentiation becomes difficult. Competition defaults to marketing spend and athlete endorsements.

PUMA carved out unique territory at “performance + culture” through strategic partnerships and extensive research that took decades to build. Red Bull Racing partnership (motorsport culture). Porsche Design collaboration (premium lifestyle). BMW Motorsport connection (performance innovation). These weren’t random sponsorships. They were strategic positioning moves that gave PUMA cultural credibility no pure performance brand could match.

This position allowed PUMA to command premium pricing while maintaining cultural relevance – a combination most competing brands couldn’t replicate. The position became IP. It informed product development (motorsport-inspired collections that blend performance and fashion). It determined partnership strategy (cultural brands, not just athletic sponsorships). It shaped retail experience (stores that feel like cultural destinations).

The key insight: PUMA didn’t find an empty quadrant and try to fit into it. They identified territory they could own through IP (partnerships and cultural connections built over decades) that competing brands couldn’t easily copy.

Example 2: Brand Strategy / Consulting Market

Analysis:

Most brand consultancies position as generalists (“we work with any industry”) or tactical executors (“we’ll handle your social media, website, and design”). This creates commodity positioning where clients choose based on price or availability, not strategic value in the marketplace.

unmtchd. owns the intersection of “strategic IP development” and “fashion/sports/culture expertise” – a position no competitor can easily replicate because it’s built on specific experience. Twenty years building brand systems at Disney (entertainment IP), Warner Bros (media franchises), Paramount (content ecosystems), and PUMA (performance culture positioning). That experience can’t be purchased or faked.

This positioning determines everything: who the potential customer is (founders and brand leaders in fashion/sports/culture, not generic businesses), what brand’s offering includes (IP mapping and ecosystem building, not logo design or social media management), what content is created (strategic frameworks about ownership and IP, not growth hacks), and what partnerships make sense (cultural brands and institutions, not random SaaS platforms).

The position becomes defensible because the IP backing it – two decades of experience at specific companies building specific types of brand systems – can’t be replicated by agencies that worked with local restaurants and B2B software companies.

Example 3: Coffee Market

Nespresso provides a classic instance of positioning creating entirely new territory. They didn’t compete on “best coffee” (everyone claims that) or “cheapest coffee” (commodity race to bottom). They positioned as “premium coffee experience at home” – owning the territory between commodity coffee and coffeehouse ritual.

Source: https://www.nespresso.com/us/en/black-friday-deals

That positioning was backed by IP: the proprietary pod system, the machine ecosystem, the subscription model, the boutique retail experience. Competing brands couldn’t simply copy the position because Nespresso owned the infrastructure that made it real. The positioning enabled ecosystem building: machines, pods, subscription service, boutique stores, and member programs.

Key takeaways across examples:

Effective product positioning maps reveal unique territory, not just empty quadrants that seem available. The best positions are backed by defensible IP – partnerships that took decades to build (PUMA), experience that can’t be replicated (unmtchd.), or proprietary systems and ecosystems (Nespresso).

Positioning enables ecosystem building, not just marketing differentiation in the marketplace. Strategic positions compound over time while tactical positions get copied and commoditized.

Brand Positioning Map FAQs

What’s the Difference Between a Brand Positioning Map and a Perceptual Map?

A perceptual map and a brand positioning map are often used interchangeably, but there’s a subtle strategic difference worth understanding for marketers. A perceptual map shows how consumers currently perceive brands across specific attributes – it’s based on customer research, focus groups, and data reflecting actual marketplace perception. A brand positioning map is a strategic tool that plots where you want to position your brand relative to competing brands based on your strategic intent and IP capabilities.

In practice, the best approach combines both: use perceptual mapping to understand current customer perception and validate whether your positioning is landing as intended, then use strategic product positioning maps to chart where you want to move based on IP you can develop.

The gap between perception and positioning strategy equals your brand-building work. For instance, if customers perceive you as “budget-friendly” but your strategy positions you as “premium,” you have a gap to close through consistent experience, elevated touchpoints, and strategic communication. If customers perceive you as “traditional” but your strategy positions you as “innovative,” you need product launches, partnerships, and experiences that shift perception.

Ultimately, positioning maps should reflect both current reality (customer perception from extensive research) and strategic ambition (IP-driven differentiation you’re building toward). The tension between these two creates your roadmap for brand development over the next 12-24 months.

What Are the Key Dimensions for a Brand Positioning Map?

The “right” dimensions depend on your industry, audience values, and strategic goals. Ultimately, effective attributes reveal competitive dynamics and strategic opportunities. Here are frameworks for choosing dimensions that provide valuable insights to marketers:

For Product Brands:

- Price Position (Accessible ↔ Premium)

- Innovation Approach (Traditional/Proven ↔ Cutting-Edge/Experimental)

- Distribution Strategy (Mass Market/Everywhere ↔ Selective/Exclusive)

- Brand Experience (Functional/Transactional ↔ Emotional/Experiential)

- Business Model (Product-Focused ↔ Ecosystem/Platform)

For Service Brands:

- Service Delivery (DIY/Self-Service ↔ Full-Service/Done-For-You)

- Expertise Focus (Generalist/Broad ↔ Specialist/Deep)

- Scale Approach (Boutique/Intimate ↔ Enterprise/Scalable)

- Methodology (Framework-Driven/Systematic ↔ Custom/Adaptive)

- Pricing Model (Project-Based ↔ Retainer/Membership/Subscription)

For Creator/Founder Brands:

- Content Strategy (Volume/Frequency ↔ Depth/IP Development)

- Monetization Model (Sponsorships/Ads ↔ Products/Ecosystems/Ownership)

- Community Approach (Audience Size/Reach ↔ Community Depth/Value)

- Brand Focus (Teaching/Education ↔ Building/Systems/Infrastructure)

- Platform Strategy (Multi-Platform/Distributed ↔ Owned Platform/Ecosystem)

unmtchd. recommendation for choosing dimensions:

Select one attribute that reflects industry standards or category norms (to show competitive clustering and why that’s problematic for differentiation in the marketplace). Then choose one attribute that reflects your unique lens, IP, or strategic capability (to reveal white space only you can fill based on defensible advantages).

Avoid generic pairs like “price + quality” – they create maps where everyone clusters in “high quality, fair price” with no meaningful differentiation. Choose dimensions that reveal your IP territory and strategic opportunity based on actual consumer preferences.

What Are Common Mistakes When Creating Brand Positioning Maps?

After working on positioning strategies for brands like PUMA, Disney, and Warner Bros, these are the positioning mistakes that appear repeatedly and undermine strategic value for marketers:

Mistake 1: Choosing Generic Attributes That Reveal Nothing

Mapping “price versus quality” tells you nothing strategic about the marketplace. Everyone clusters in “high quality, premium price” or “good quality, fair price.” Choose attributes that reveal actual differentiation based on your market. For instance, in athletic wear, “performance focus versus lifestyle focus” reveals more than “price versus quality.” For consultancies, “framework-driven versus custom approach” reveals more than “small versus large.”

Mistake 2: Plotting Wishful Thinking Instead of Current Reality

Your positioning map should reflect how potential customers currently perceive you based on extensive research and behavior, not how your brand guidelines say you should be perceived. Start with truth, validated through customer feedback, focus groups, and market data, then chart where you want to move based on IP you’ll build. The gap between current perception and strategic ambition is your brand development roadmap.

Mistake 3: Chasing Empty Quadrants Without Validation

An empty space on your map doesn’t automatically mean opportunity. It might mean that position is undesirable to customers (they don’t value that combination of attributes based on consumer preferences), unprofitable to serve (margins don’t support the business model), or indefensible (competing brands can easily copy once you prove the market). Validate white space through three filters: Is it desirable? Is it defensible through your IP? Is it profitable?

Mistake 4: Creating Maps Based on Internal Assumptions, Not Customer Research

Positioning maps built on internal opinions and ideas fail when they meet marketplace reality. Validate your attribute selection and brand plotting with actual customer data – surveys, interviews, focus groups, social listening, behavioral data. What you think your position is rarely matches what customers perceive.

Mistake 5: Stopping at the Map Without Translation into Strategy

The map is a diagnostic tool that provides valuable insights, not a complete marketing strategy. The real work is translating insights into positioning statements, go-to-market strategy, product development priorities, partnership criteria, and IP development. A map sitting in a slide deck creates zero value. A map that informs every strategic decision compounds over time.

From Positioning Map to Brand Ecosystem

A brand positioning map shows you where you stand and where you could move in the marketplace. But the brands that last – the ones that build nine-figure value and beyond – don’t just find positioning gaps. They identify what unique territory they can own through intellectual property, then build ecosystems around that ownership.

Your positioning reveals your IP opportunity and ultimately defines your brand promise to potential customers. PUMA’s position at “performance meets culture” unlocked partnerships with Red Bull Racing, Porsche Design, and BMW Motorsport – partnerships that became IP, creating a brand ecosystem no competing brand could replicate.

Disney’s position as “immersive story universes” unlocked theme parks, merchandise systems, streaming platforms, and experience design – an ecosystem built on IP ownership that compounds over decades. unmtchd.’s position at “IP-led brand strategy for fashion/sports/culture” unlocked advisory services, community membership, strategic frameworks, and partnership opportunities – all extensions of positioning rooted in 20 years of experience building brand systems.

The map is step one. The ecosystem is the long game. The ideas you visualize today become the IP you build tomorrow.

Brand positioning maps reveal competitive landscape and strategic opportunities when used correctly – not as static snapshots but as dynamic tools for identifying what you can own. The best positioning strategies are backed by defensible IP: frameworks competing brands can’t replicate, methodologies developed through years of experience, unique perspectives from cultural position, or partnership ecosystems that take decades to build.

Effective positioning enables ecosystem building beyond single products – creating interconnected offerings (products, content, partnerships, community, experiences) that reinforce the same strategic position. Consistency over 3-5 years turns positioning into brand equity and long-term market value. Ultimately, strategic positioning becomes your competitive moat in the marketplace.

Ready to identify your brand’s unique IP territory and build a positioning strategy that lasts? Contact us to see how unmtchd. helps founders and brand leaders turn positioning insights into IP-led ecosystems.